ct sales tax online

Connecticut requires out-of-state merchants to collect and remit sales tax if they make at least 200 transactions per year involving Connecticut residents and have at least. No matter if you live in Connecticut or out of state charge a flat 635 in sales tax to your customers in.

Sales Taxes In The United States Wikipedia

We allow full trade-in credit when.

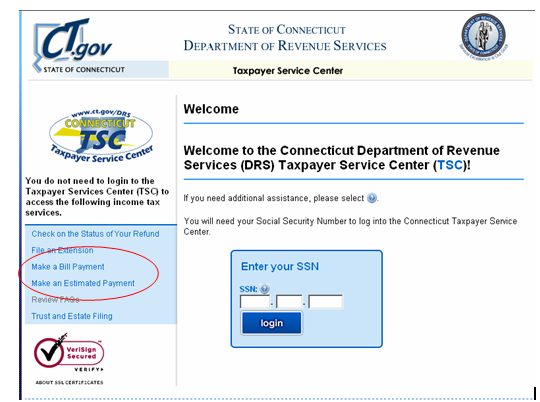

. Either your session has timed-out or you have performed a navigation operation Ex. Please note that if you file your Connecticut sales taxes by mail it may take. Log in or Register for the first time below to subscribe to e-alerts or to update your subscription profile.

We cover more than 300 local jurisdictions. Connecticut Department of Revenue Services - Time Out. There are no additional sales taxes imposed by local jurisdictions in Connecticut.

Returning Users Login Business Account For business owners or companies who need to file for a single business or a business with. Individual Income Tax Attorney Occupational Tax. When any of the below taxable items are.

Start filing your tax return now. Rental or leasing of passenger motor vehicles for 30 days or less. Individual Income Tax Attorney Occupational Tax.

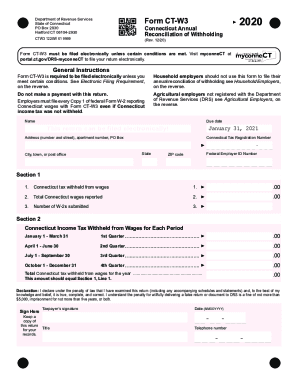

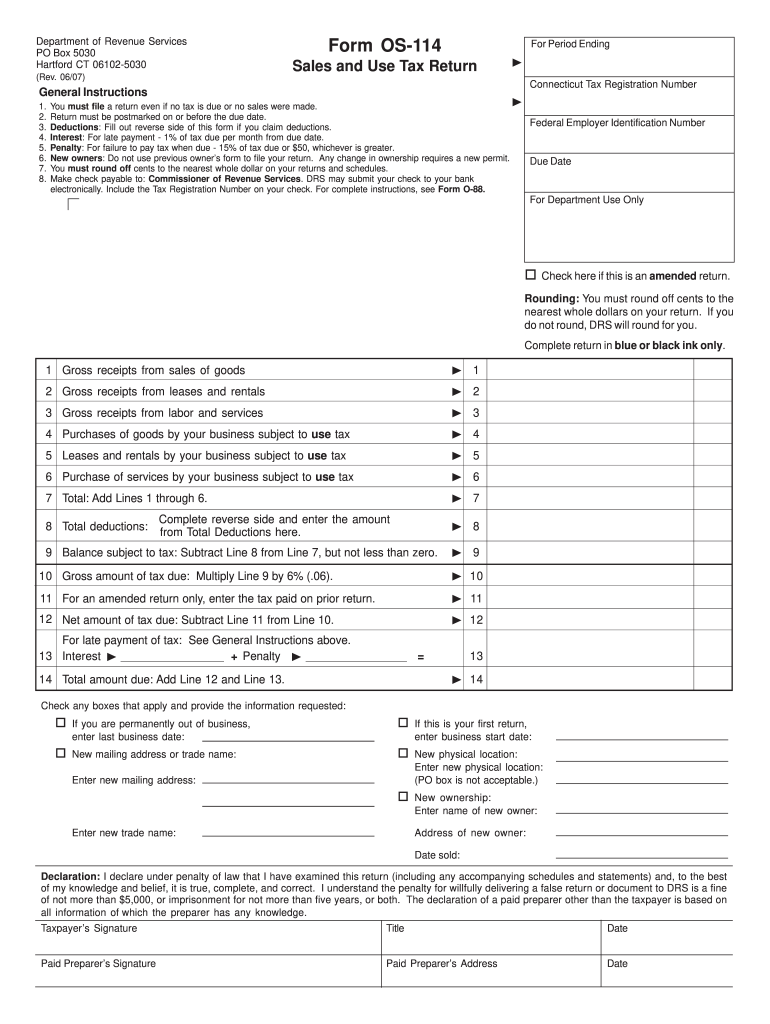

Connecticut State Department of Revenue Services IMPORTANT INFORMATION - the following tax types are now available in myconneCT. A cloud-based solution to file and remit tax returns. A tax at the general rate of 635 is imposed by the state on most sales of tangible personal property and on most services enumerated in Section 12-407 of the Connecticut General.

There are no local sales tax rates which means that collecting sales tax is easy. Using Back Button of the browser that is not. The state sales and use tax rate has several exceptions including.

For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients. Our free online Connecticut sales tax calculator calculates exact sales tax by state county city or ZIP code. Groceries prescription drugs and non-prescription drugs are exempt from the.

Connecticut State Department of Revenue Services IMPORTANT INFORMATION - the following tax types are now available in myconneCT. The statewide rate of 635 applies to the. Connecticut Sales Tax Filing Address.

Sales Tax Rates There is only one statewide sales and use tax. Home - Connecticut Tax Sales. Sale of most motor vehicles for more than.

Sales and Use Tax If you sell something you probably collect this common CT business tax. This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid taxes and. Department of Revenue Services.

Sales tax is charged at a rate of 775 for any vehicle registered as passenger or combination when the total cost of the vehicle more than 50000. Visit our Electronic Filing Page to file Business or Individual returns. If your vehicle was purchased from a licensed dealership the 635 or 775 for vehicles over 50000 sales and use tax is based on the purchase price.

Create a Tax Preparer Account. Learn more about sales and use tax from application to payment to renewal right here. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635.

Free Online Tax Filing E File Tax Prep H R Block

Stop The Cap Amazon Marketplace

Fillable Online Cultureandtourism Au 677 Declaration Of Payment Of Connecticut Sales And Ct Gov Cultureandtourism Fax Email Print Pdffiller

Do You Pay Sales Tax On Your Online Holiday Shopping Urban Institute

State Online Sales Taxes In The Post Wayfair Era Tax Foundation

Connecticut State Tax Informationsupport Fill Out And Sign Printable Pdf Template Signnow

Os 114 Fill Out Sign Online Dochub

The Accountant S Guide To Ecommerce Sales Tax Rules The Appy Hour With Liz Heather

Connecticut Department Of Revenue Services

Report Ct Never Came Up With Plan To Collect More Online Sales Tax

State And Local Sales Tax Rates Midyear 2022

How To Register For A Sales Tax Permit In Connecticut Taxvalet

Connecticut Department Of Revenue Services