capital gains tax changes proposed

Long-Term Capital Gains Taxes. Along with raising the corporate tax rate to 28 and the top individual rate to 396 widespread changes have been proposed to the capital gains tax rate and estate tax.

There S A Growing Interest In Wealth Taxes On The Super Rich

4 rows Proposed capital gains tax Under the proposed Build Back Better Act the top marginal.

. Under the proposed law there would be only two ways to avoid paying capital gains tax entirely. Proposed changes to Capital Gains Tax Current CGT rate Proposed CGT rate. Although the concept of capital gains tax is not new to Canadians there have been several.

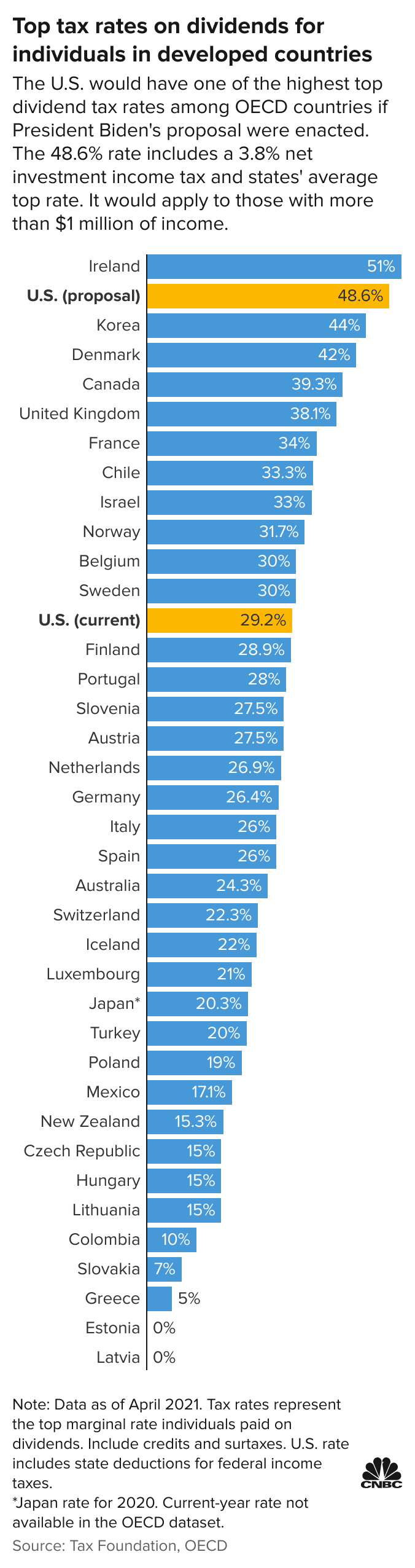

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. Bidens plan is to raise taxes and not just by upping tax rates but also by changing how and when taxes are collected. Long-term capital gains tax applies to appreciated assets sold after holding them for at least one year.

In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. West Virginia Tax rate.

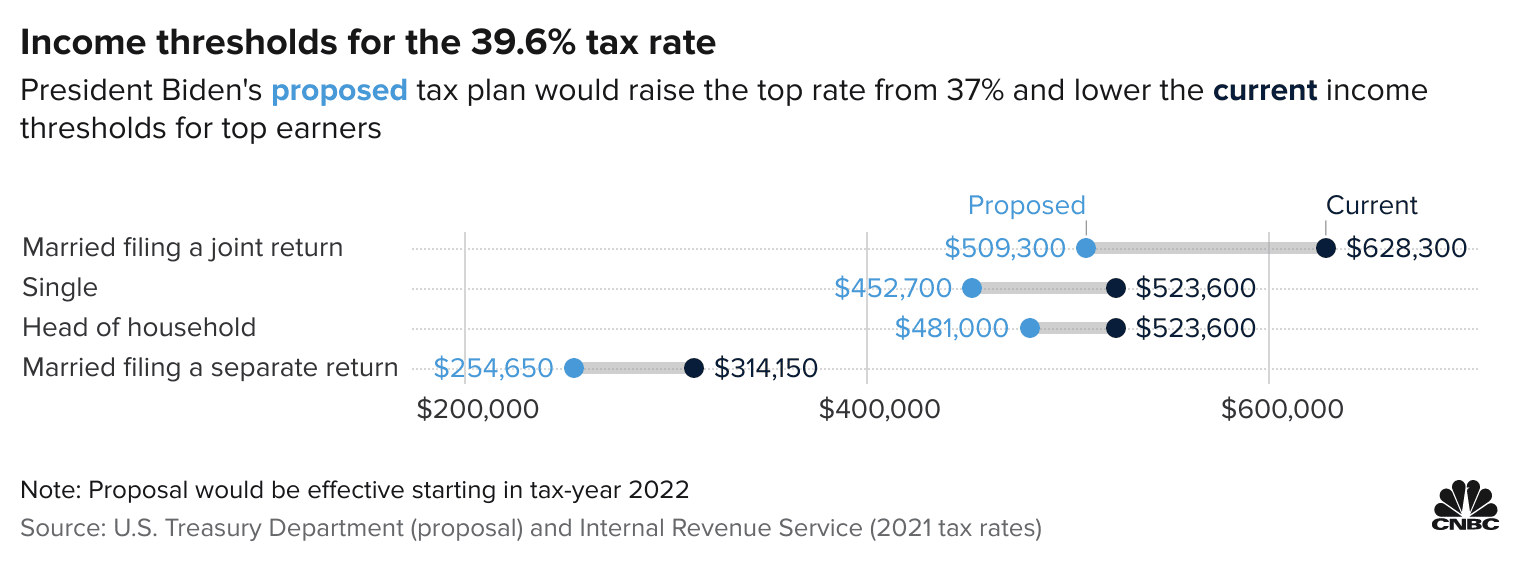

A proposed increase in the top ordinary income tax rate from 37. Proposed Capital Gains Tax Changes. A retroactive change may be hard to get through congress because capital gains rates have been.

Understanding Capital Gains and the Biden Tax Plan. Additionally assets would be taxed upon the death of their owner as if they were sold. And Starting From January 1 2022 The Bill Proposes To Realign The Top 25 Capital Gains Rate Threshold With The 396 Personal Income Tax Rate.

The increased rate would also apply to qualified dividends which is what US corporations generally pay their. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Donating assets to charity will also continue to be a strategy to avoid paying capital.

President Bidens proposal to increase the capital gains tax has generated tremendous discussion. Proposed Capital Gains Tax Rate 2022. Over the last year there has been considerable speculation like most other things these days about the Federal Government increasing the inclusion rate of capital gains tax in Canada.

Possible Changes Coming to Tax on Capital Gains in Canada. Youll owe either 0 15 or 20. How Proposed Changes to Capital Gains Taxes Would Affect You.

Under the proposed change this taxpayers heirs would owe taxes on the 40 in capital gains should they sell the holding Nixon says. In Bidens proposed capital asset taxes plan the top capital gains rate would increase. These higher taxes would apply.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Under current federal law upon death property passes to a beneficiary at fair market value with a few exceptions. On April 28 the Biden administration released its FY 2022 revenue proposals.

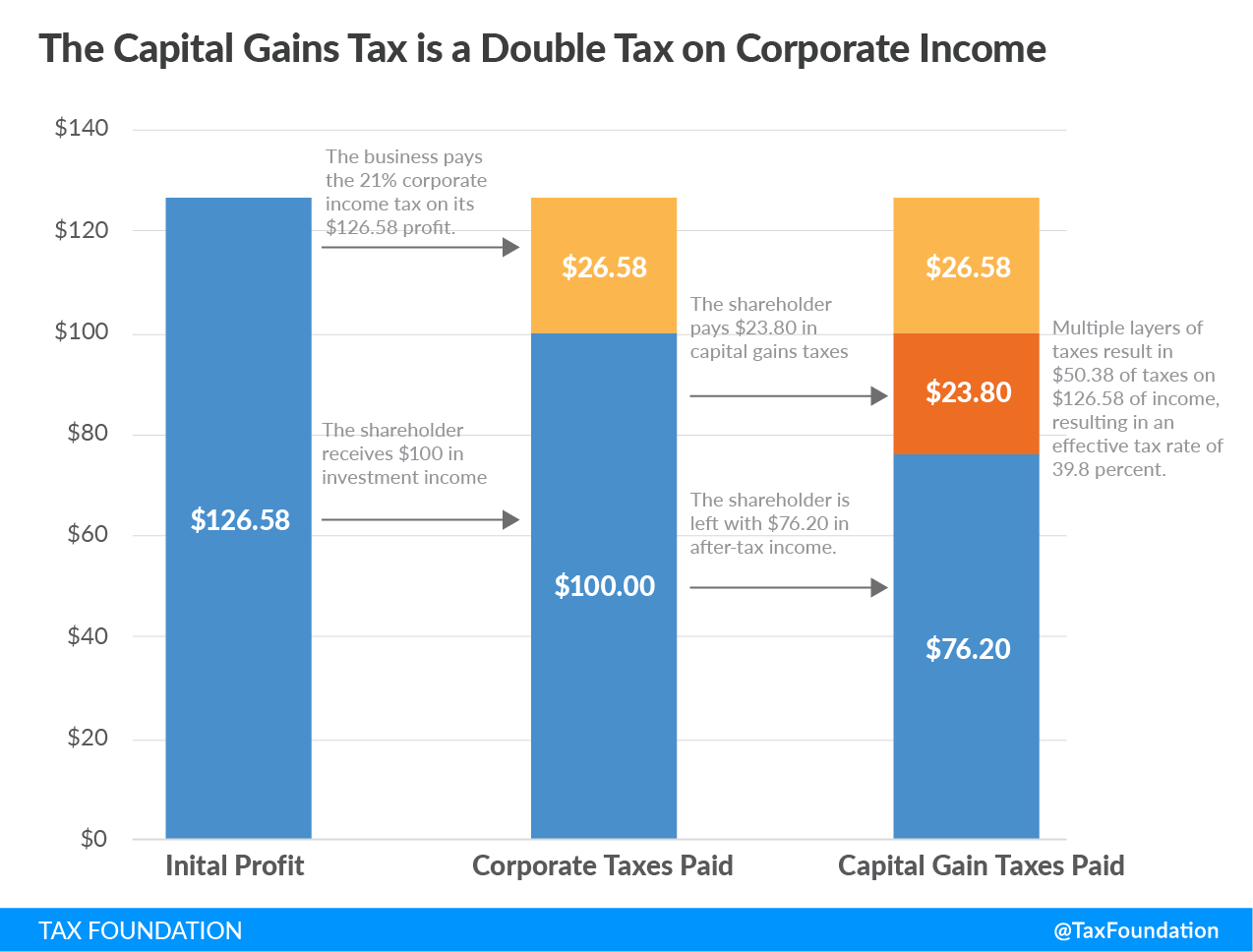

The present capital gains tax rate for long-term capital gains and qualified dividends is 20 for taxpayers in the highest tax bracket 15 for the next four tax brackets and 0 for taxpayers in the two lowest tax brackets. Looking at this proposed change in the context of past changes shows that both Democratic and Republican presidents have signed legislation with retroactive tax provisions. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

When the NIIT is added in this rate jumps to 434. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains. There is currently a proposed bill that would tax long-term capital gains earnings above 25000 for individual filers and above 50000 for joint filers.

Currently the top ordinary rate for individ. The tax hike would apply to households making more than 1 million. Currently the flat supplemental wage withholding rate which applies to income such as stock compensation and cash bonuses is 22 for yearly amounts up to 1 million and 37 for.

President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. 21 hours agoUnder the Biden Administration proposal flow-through entities would be required to compute the character of gains and losses on the sale or disposition of section 1250 property and report to the entity owners the amounts of ordinary income or loss capital gain or loss and unrecaptured section 1250 gain under both existing and proposed rules. According to Section 138202 of the bill the maximum tax rate on these would increase from 20 to 25.

When including the net investment income tax the top federal rate on capital gains would be 434 percent. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. This will affect the amount of money and value of assets left to beneficiaries and alter the estate planning process.

Wealthier Americans who have been exempt from estate taxes will feel. Family businesses and farms that are passed on in an estate would be exempt if the heir continues to run them. Individuals In the American Families Plan AFP the Biden Administration is proposing an increased tax rate on capital gains and qualified dividends to equal the top ordinary income tax rate of 396 for households earning over 1 million or 500000 if married filing separately.

In effect this proposal completely eliminates the preferential capital gains tax rate for these taxpayers.

Double Taxation Definition Taxedu Tax Foundation

What You Need To Know About Capital Gains Tax

Capital Gains Tax What It Is How It Works Seeking Alpha

How To Calculate Capital Gains And Losses

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Like Kind Exchanges Of Real Property Journal Of Accountancy

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Can Capital Gains Push Me Into A Higher Tax Bracket

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Biden Tax Plan And 2020 Year End Planning Opportunities How To Plan Tax Tax Brackets

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What You Need To Know About Capital Gains Tax

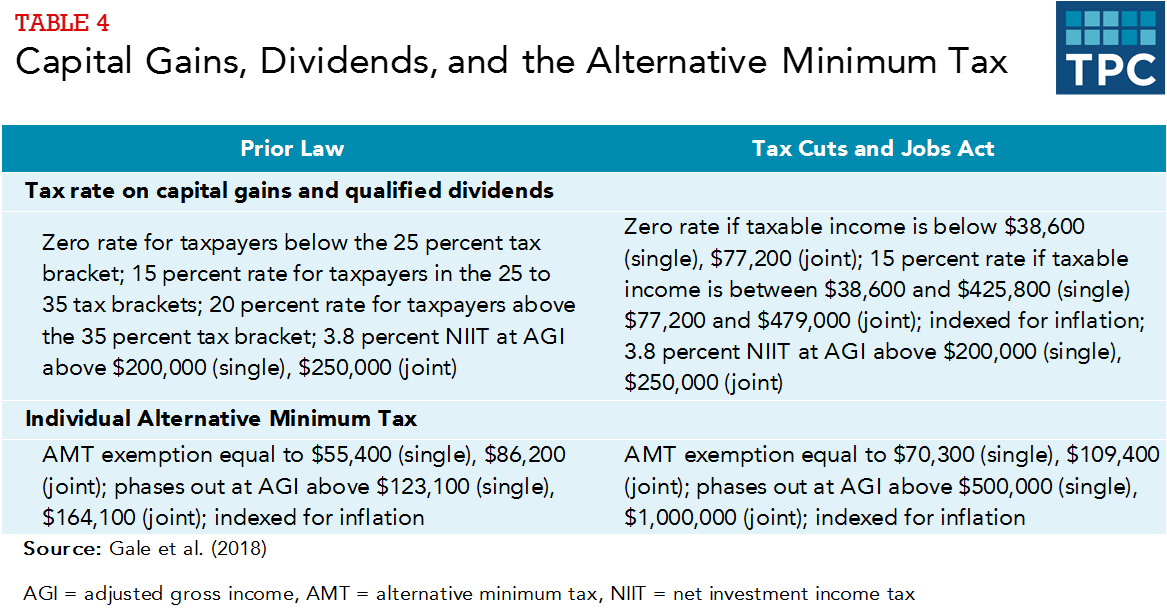

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)